The Kane Firm recently mailed clients a yellow Tax Organizer packet to aide in collecting 2016 tax information. Shortly after we mailed the organizers, on January 11, 2017, the New York State Department of Taxation informed tax preparers of a new requirement for the 2016 tax year.

This tax season, all New York State personal income tax returns require either the primary taxpayer or spouse’s driver license or state identification information. This information will be used in the e-filing process in an effort to deter fraud. The information will not appear on the tax return. The specific data points required are:

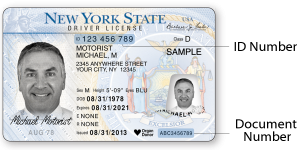

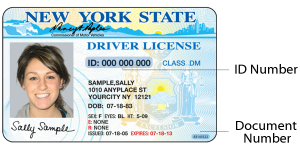

- License or ID Number: The 9-digit number at the top of your license, permit or non-driver ID

- Issuing State: The state that issued the driver license

- Issue Date: Date Issued

- Expiration Date: Date of Expiration

- Document Number (New York State Only): The 8 or 10-digit ID on the lower right corner of your license, permit or non-driver ID, or on the back if it was produced after January 28, 2014. Please refer to the pictures below to find this number. Note: If you recently replaced your document and haven’t received it in the mail yet, you need to wait for your new document to arrive.

In order to expedite the processing of your tax return, please provide this information when sending in your tax information. You may include this in the “Identity Authentication” section of the tax organizer or you may send in a copy of the front and back of your license.

Read more about this requirement on the New York State Department of Taxation website.

Leave a Reply